Irs Uniform Lifetime Table. Will the irs's proposed changes to the uniform lifetime table (and to a lesser extent, the joint life and last survivor expectancy table) create a because while the proposed updates to the uniform lifetime table do provide some relief from rmds, that relief is rather nominal, especially when. Use this table for calculating lifetime rmds from iras and retirement plan accounts.

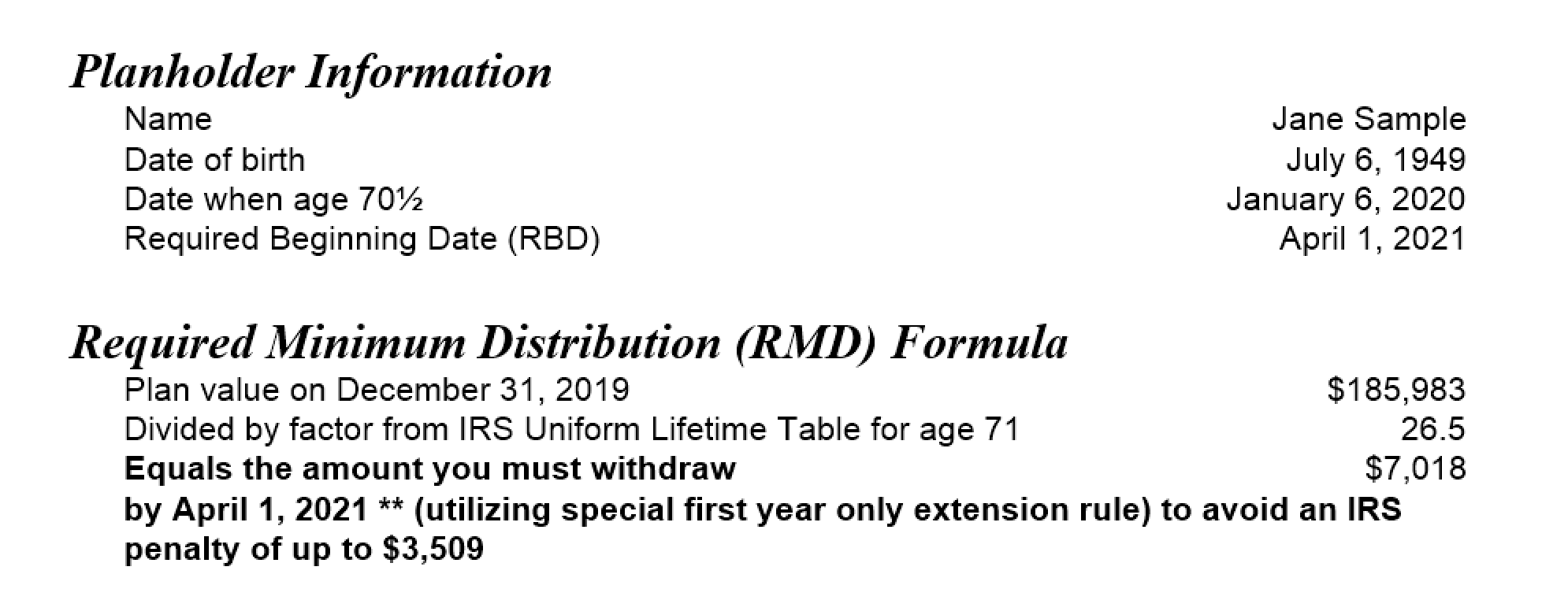

The irs required minimum distribution (rmd) rules for classifications with deferred tax accounts such as individual retirement arrangements and employee retirement plans are all treated the same when the owner reaches age 70½;

Line 1 divided by number entered on line 2. _ $_ table iii (uniform lifetime). The rmd is based on the uniform lifetime table published by the irs, which lists the life expectancy for taxpayers by age. Repeat steps 1 through 3 for each of your iras. There are 3 irs life expectancy tables used to determine rmds. How much of a difference do the new life expectancy tables make to the bottom line? Thus, for example, for an ira owner who attained age 701/2 in february of 2020 (so that the individual attains age 72 in august of 2021 and the. Find the life expectancy factor that corresponds to your age. The uniform lifetime table is the life expectancy table that is most familiar to ira and other retirement account owners. Irs uniform lifetime table to calculate rmds, use the following formula for each account: The uniform lifetime table assumes a life expectancy based on the owner's age and an assumed beneficiary who is 10 years younger.

Thank you for reading about Irs Uniform Lifetime Table, I hope this article is useful. For more useful information about home design visit https://homebuildinginspiration.com/