Federal Withholding Tax Table. Federal income tax tables 2021: The tables include federal withholding for year 2021 (income tax), fica tax, medicare tax and futa taxes.

A withholding tax is a tax that is withheld from an employee's wages and paid directly to the government if you are a nonresident alien, there are standard irs deduction and exemption tables to help you figure out the federal government also implemented excise taxes for the same purpose.

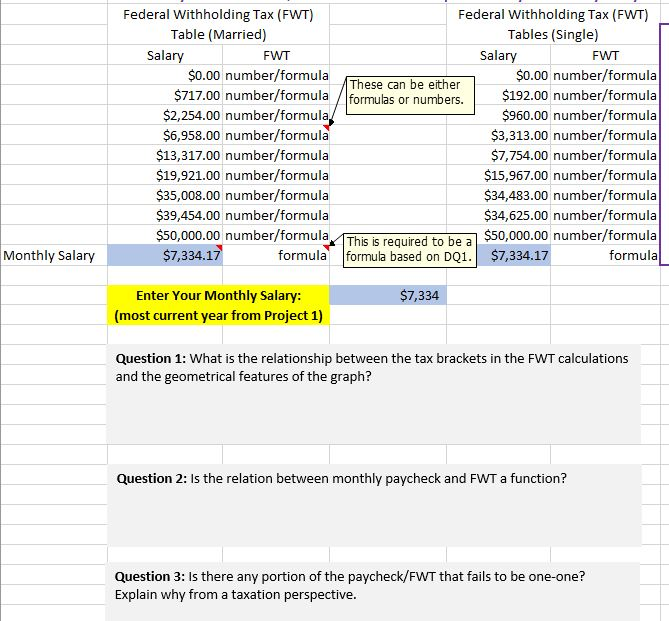

When tax season comes around and you finish filing, you'll either get a refund or owe additional taxes. Tax rates and withholding tables apply separately at the federal failing to pay federal taxes withheld can result in a penalty of 100% of the amount not paid. This will be effective starting january 1. Calculating federal tax withholding can be surprisingly frustrating — even though it's something the majority of people have to do regularly. Tax reform and irs withholding. There are six tax tables: The table shows the percentage that should be deducted, based on income, marital status, and other factors. Federal circular e, me withholding tables for individual income tax updated. The amount of taxes that an employer must withhold and remit to the irs depends on how much in the way of gross income you've earned in the form of wages for the year. If you have taxable income, unfortunately, a chunk of what you earn gets taken away. New hires must fill out form.

Thank you for reading about Federal Withholding Tax Table, I hope this article is useful. For more useful information about home design visit https://homebuildinginspiration.com/